Sure! Here’s a 50-word introduction in Spanish for your blog article about «Does Florida offer a solar tax credit?»:

«¿Ofrece Florida un crédito fiscal para la energía solar? Descubre en este artículo si puedes aprovechar los beneficios fiscales al instalar paneles solares en tu hogar o negocio en Florida. Aprende sobre los requisitos y condiciones que aplican, así como los posibles incentivos económicos que podrías recibir. ¡Ahorra dinero y ayuda al medio ambiente con la energía solar!»

Unlocking Savings: Exploring Florida’s Solar Tax Credit for Solar Company Tampa

Unlocking Savings: Exploring Florida’s Solar Tax Credit for Solar Company Tampa

Florida offers a valuable incentive for homeowners looking to switch to solar energy. The state’s solar tax credit allows residents to save up to 20% on the cost of installing a solar system for their homes. This means that Solar Company Tampa customers can unlock significant savings when making the switch to clean, renewable energy.

The solar tax credit works by allowing homeowners to deduct a portion of the cost of their solar system installation from their state income taxes. This tax credit can help offset the upfront costs of going solar, making it a more affordable option for many families in the Tampa area.

In addition to the immediate savings provided by the solar tax credit, switching to solar energy can also lead to long-term financial benefits. By generating their own electricity, homeowners can reduce their dependence on traditional energy sources and lower their monthly utility bills. Over time, these savings can add up, allowing Solar Company Tampa customers to recoup their initial investment and enjoy ongoing savings.

Not only does the solar tax credit benefit homeowners financially, but it also contributes to a cleaner and more sustainable future. By encouraging the adoption of solar energy, the state of Florida is reducing reliance on fossil fuels and decreasing greenhouse gas emissions. Solar Company Tampa is proud to be part of this movement towards a greener and healthier environment.

In conclusion, Solar Company Tampa customers have the opportunity to unlock significant savings through Florida’s solar tax credit. By taking advantage of this incentive, homeowners can make the switch to solar energy more affordable and enjoy long-term financial benefits. At the same time, they are contributing to a cleaner and more sustainable future for Tampa and beyond.

Frequent Questions

Is there a solar tax credit available for homeowners in Tampa, Florida through Solar Company Tampa?

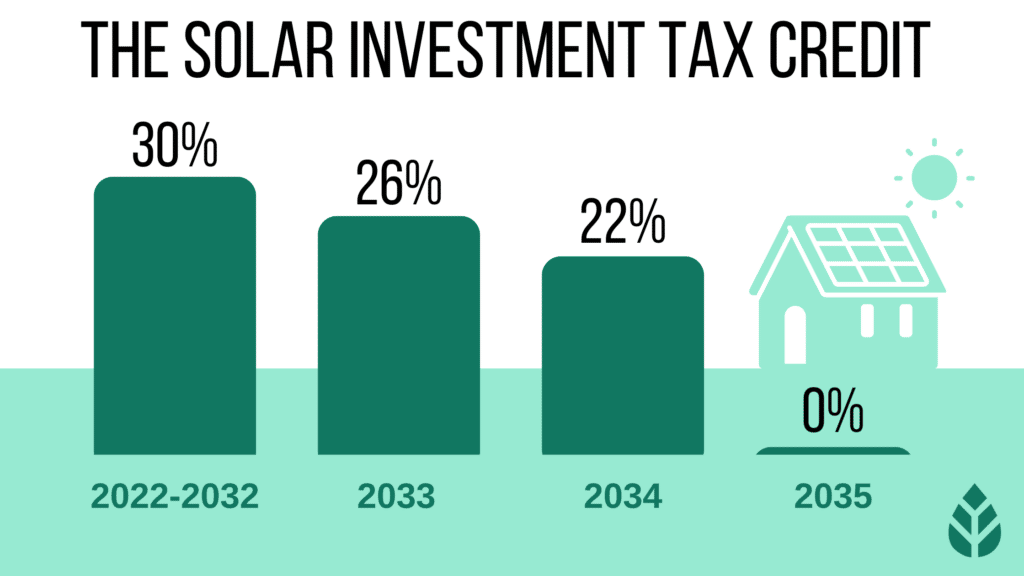

Yes, there is a solar tax credit available for homeowners in Tampa, Florida through Solar Company Tampa. The federal government offers a Solar Investment Tax Credit (ITC) which allows homeowners to deduct 26% of the cost of installing a solar energy system from their federal taxes. This tax credit applies to both solar photovoltaic (PV) systems and solar water heating systems. It’s important to note that the ITC is a non-refundable tax credit, meaning it can only be used to offset taxes owed and cannot be carried forward or refunded. Additionally, it’s always recommended to consult with a tax professional for personalized advice and guidance regarding tax credits and incentives.

What are the qualifications and requirements for claiming the solar tax credit offered by Solar Company Tampa in Florida?

To qualify for the solar tax credit offered by Solar Company Tampa in Florida, there are certain qualifications and requirements that need to be met:

1. Residential Property: The solar tax credit is available for residential properties, including single-family homes, townhouses, and apartments.

2. Solar Energy System Installation: The property must have a solar energy system installed by Solar Company Tampa. This can include solar panels, solar water heaters, or solar-powered air conditioning systems.

3. System Eligibility: The solar energy system must meet specific requirements and be certified by the Solar Rating and Certification Corporation (SRCC) or a comparable entity. The system should be intended to generate electricity for the property or provide hot water for use within the property.

4. Ownership: The individual claiming the tax credit must be the owner of the property. If the property is leased, the property owner may be eligible for the tax credit.

5. Initial Placement: The solar energy system must be placed in service between January 1, 2006, and December 31, 2023. The tax credit is not retroactive for systems installed prior to 2006.

6. Tax Liability: To claim the tax credit, the individual must have a tax liability at least equal to the amount of the credit. The credit cannot be used to generate a refund if there is no tax liability.

It is essential to consult a tax professional or the Internal Revenue Service (IRS) for complete and up-to-date information regarding the solar tax credit and its requirements in order to ensure eligibility and accurate filing. The information provided here is a general overview and should not be considered as professional tax advice.

How much can I potentially save on my taxes by taking advantage of the solar tax credit offered by Solar Company Tampa for residents in Florida?

By taking advantage of the solar tax credit offered by Solar Company Tampa for residents in Florida, you can potentially save **30%** of the total cost of your solar panel installation. The federal solar investment tax credit, also known as the ITC, allows homeowners to deduct 30% of the total cost of their solar energy system from their federal taxes. This tax credit applies to both the purchase and installation costs of your solar panels.

For example, if your solar panel installation costs $20,000, you would be eligible for a tax credit of $6,000 ($20,000 x 0.30 = $6,000). This means you can deduct this amount from your federal taxes owed. However, it’s important to note that this tax credit is subject to phase-out, which means the credit percentage will gradually decrease over time. As of now, the 30% tax credit is available until the end of 2022, after which it will begin to decline. Therefore, it’s beneficial to take advantage of this generous tax incentive as soon as possible.

To fully understand the potential savings on your taxes, it is advisable to consult with a tax professional who can provide personalized advice based on your specific circumstances.

In conclusion, for residents of Tampa looking to invest in solar energy, the question of whether Florida offers a solar tax credit is one that holds significant importance. The answer is yes! Florida does indeed provide a solar tax credit, making it even more enticing for homeowners and businesses to adopt solar power solutions. This incentive allows individuals to offset a portion of their initial investment in solar panels and installation costs through a reduction in their taxes. By taking advantage of this tax credit, Floridians can not only save money but also contribute to a cleaner and more sustainable future. Solar Company Tampa is committed to assisting customers in navigating the complexities of solar tax incentives, ensuring they make informed decisions that maximize their financial benefits. So, don’t miss out on the opportunity to go solar and reap the rewards offered by Florida’s solar tax credit program. Embrace renewable energy today and make a positive impact on both your wallet and the environment!