Sure! Here’s a brief introduction for your blog article on «Is leasing solar the same as PPA?» in Spanish:

«¿Es el arrendamiento de energía solar lo mismo que un acuerdo de compra de energía (PPA)?» Esta es una pregunta común en la industria solar y puede generar confusión. En este artículo, exploraremos las diferencias entre el arrendamiento solar y un PPA, para que puedas tomar una decisión informada sobre la mejor opción para tu negocio o hogar en Tampa.

Is Solar Leasing the Same as Power Purchase Agreements (PPAs)?

No, solar leasing and power purchase agreements (PPAs) are not the same. While both options allow homeowners and businesses to go solar without having to purchase a system outright, there are key differences between the two.

Solar leasing involves renting a solar energy system from a third-party provider. The homeowner or business pays a fixed monthly lease payment to the leasing company in exchange for the use of the solar panels. The leasing company owns and maintains the system, and they are responsible for any repairs or maintenance.

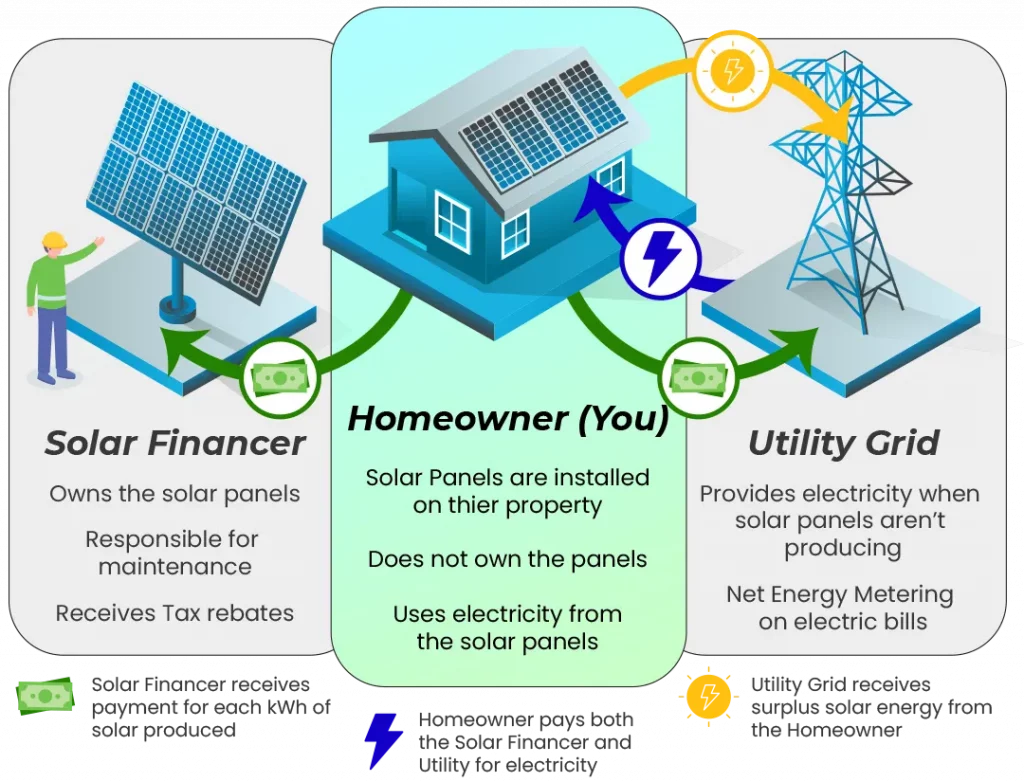

Power purchase agreements (PPAs), on the other hand, involve a long-term contract between the homeowner or business and a solar energy provider. Instead of leasing the system, the customer agrees to purchase the electricity generated by the solar panels at a predetermined rate. The solar provider owns and maintains the system, and they are responsible for any repairs or maintenance.

While both options can provide cost savings and reduce dependence on traditional energy sources, the main difference lies in how the payments are structured. With a solar lease, the customer pays a fixed monthly amount regardless of how much solar energy the system generates. In a PPA, however, the customer pays for the actual energy produced by the system.

Overall, the choice between solar leasing and PPAs depends on the specific needs and preferences of the homeowner or business. It’s important to carefully consider the terms, financial implications, and long-term benefits of each option before making a decision.

Frequent Questions

What are the key differences between leasing solar panels and entering into a Power Purchase Agreement (PPA) with Solar Company Tampa?

Leasing Solar Panels: When you lease solar panels from Solar Company Tampa, you essentially rent the equipment for a fixed monthly fee. This means that Solar Company Tampa retains ownership of the panels and is responsible for their maintenance and repairs. As the lessee, you benefit from the electricity generated by the panels, which offsets your traditional utility bills. However, you do not have access to any tax incentives or rebates associated with solar panel ownership.

Power Purchase Agreement (PPA): With a Power Purchase Agreement, you also do not own the solar panels installed on your property. Instead, Solar Company Tampa installs and maintains the panels, and in exchange, you agree to purchase the electricity they generate for a predetermined price per kilowatt-hour (kWh). The main difference from leasing is that you only pay for the electricity generated by the panels, rather than a fixed monthly fee. This can lead to lower monthly costs if the energy production exceeds your consumption. Additionally, as the electricity consumer, you may not benefit from certain tax credits or incentives, as those typically go to Solar Company Tampa as the owner of the panels.

Conclusion: The key difference between leasing solar panels and entering into a Power Purchase Agreement with Solar Company Tampa lies in the payment structure. Leasing involves a fixed monthly fee, while a PPA involves purchasing the generated electricity at a predetermined rate. Both options allow you to benefit from solar power, but the financial implications and ownership differ. It’s important to consider your specific circumstances and preferences before deciding which option is best for you.

How does the financial structure of solar panel leasing differ from that of a PPA in relation to Solar Company Tampa?

Solar Company Tampa offers two options for financing solar panels: leasing and power purchase agreements (PPAs). While both options allow customers to enjoy the benefits of solar energy without the upfront costs of purchasing a solar system, there are some differences in their financial structures.

In a solar panel leasing arrangement, the customer pays a fixed monthly fee to the solar company to lease the panels. The solar company retains ownership of the system and is responsible for its maintenance and monitoring. The customer benefits from the electricity generated by the panels but does not have any ownership rights or responsibilities. The leasing option often includes a contract term, typically ranging from 10 to 20 years, during which the customer pays the fixed monthly fee.

On the other hand, a power purchase agreement (PPA) involves a long-term contract between the customer and the solar company. Under this arrangement, the solar company installs and owns the solar panels on the customer’s property. The customer agrees to purchase the electricity generated by the panels at a predetermined rate. The solar company is responsible for the operation, maintenance, and repair of the system. The customer benefits from the discounted electricity rates compared to traditional utility prices.

One key difference between leasing and PPAs lies in who receives the financial incentives and tax benefits. In a leasing arrangement, the solar company typically retains these benefits, as they own the system. In contrast, with a PPA, the customer may be eligible to receive certain financial incentives and tax credits since they are purchasing the electricity directly from the solar company.

When considering the financial structure, customers should also consider factors such as escalation clauses, which determine how the monthly payments may increase over time. In a leasing arrangement, the monthly fees may escalate annually, while in a PPA, the cost per kilowatt-hour typically increases at a fixed annual rate outlined in the agreement.

It is essential for customers to carefully analyze and compare the financial structures and terms of leasing and PPAs provided by Solar Company Tampa, to determine which option best suits their needs and financial goals.

Can you explain the potential advantages and disadvantages of leasing solar panels versus opting for a PPA with Solar Company Tampa?

When considering solar panel options with Solar Company Tampa, there are potential advantages and disadvantages to both leasing and opting for a Power Purchase Agreement (PPA).

Leasing Solar Panels:

Advantages:

1. **Low upfront costs**: Leasing allows you to enjoy the benefits of solar energy without making a large initial investment.

2. **Maintenance and repairs**: Typically, the solar company takes care of any maintenance or repair needs during the lease term.

3. **Easy transition**: If you decide to move, you can transfer the lease to the new homeowner, avoiding the hassle of removing the panels.

Disadvantages:

1. **Limited control**: As the panels are owned by the leasing company, you have limited control over the system and may not be able to make changes or upgrades.

2. **Long-term costs**: While the monthly lease payments may be lower than electricity bills, over the long term, leasing can cost more compared to purchasing the system outright.

3. **Contract terms**: Lease agreements often have long-term contracts, typically around 20 years, which can limit your flexibility and options.

Power Purchase Agreement (PPA):

Advantages:

1. **No upfront costs**: Similar to leasing, a PPA allows you to avoid the upfront costs associated with purchasing solar panels.

2. **Fixed electricity rates**: With a PPA, you agree to purchase the solar energy generated at a predetermined rate, protecting you from potential utility rate increases.

3. **Professional maintenance**: The solar company typically takes care of maintenance and repairs, ensuring the system operates optimally.

Disadvantages:

1. **Minimum energy production**: PPAs often have minimum energy production requirements, which means you may still need to rely partially on traditional grid electricity.

2. **Long-term commitment**: Like leasing, PPAs usually require long-term contracts, which limit your options if you decide to make changes or move in the future.

3. **Limited system ownership**: With a PPA, you do not own the solar panels, meaning you may miss out on potential tax incentives or the ability to sell excess energy back to the grid.

Ultimately, the choice between leasing and a PPA with Solar Company Tampa depends on your specific financial goals, long-term plans, and the level of control you desire over your solar panel system. It’s essential to carefully review the terms and conditions of each option before making a decision.

In conclusion, when considering solar energy options for your home or business in Solar Company Tampa, it’s important to understand the distinctions between leasing solar and Power Purchase Agreements (PPAs). While both options can help you access clean and affordable solar power without the need for upfront costs, there are key differences to consider.

Leasing solar: With a solar lease, you essentially rent the solar panels from a third-party provider. This means you do not own the system, but you benefit from the electricity it generates. You will typically pay a fixed monthly lease payment, which can be less than your current utility bill. However, any incentives or rebates associated with the system go to the leasing company.

Power Purchase Agreement (PPA): A PPA is a contract that allows you to purchase the electricity generated by a solar energy system installed on your property at a predetermined rate for a specific period of time. Unlike leasing, you do not pay a fixed lease payment, but rather purchase the electricity produced by the system at a lower rate than your utility’s retail price.

While both leasing solar and PPAs provide access to solar power without upfront costs, the main difference lies in ownership. With leasing, you do not own the system, whereas with a PPA, you have the opportunity to eventually own it at the end of the agreement.

When considering which option is best for you, it’s important to evaluate factors such as long-term goals, available incentives, and financial considerations. Consulting with a reputable solar company like Solar Company Tampa can help you navigate through these options and make an informed decision that aligns with your needs and objectives.